Achieve Your Financial Goals

Tailored Financial Planning and Investment Strategies

Discover personalized financial solutions designed to help you grow and protect your wealth.

Latest Blog Posts

Accruals: Definition, Examples, and How They Work

What Are Accruals? Accruals are a fundamental concept in accounting that refers to the recognition of income and expenses in the period they are earned or incurred, regardless of when the actual cash transaction takes place. This method of accounting provides a more...

What is One Way to Begin Saving Startup Capital?

Bootstrapping Your Startup with Personal Savings One of the most common ways to begin saving startup capital is by bootstrapping your business using personal savings. Bootstrapping involves self-funding your venture, relying on your own financial resources to get your...

How Many Shares Should a Startup Company Have?

When starting a new company, one of the critical decisions founders must make is determining the number of shares to authorize and issue. Shares play a vital role in attracting investors, generating funds, and providing employee stock options. Finding the right...

Your Questions Answered

Find answers to the most common questions about our financial services.

What is financial planning?

Financial planning is the process of creating a strategy to manage your finances to achieve your life goals. It involves assessing your current financial situation, setting goals, and developing a plan to reach those goals.

How do I start investing?

To start investing, you should first determine your investment goals and risk tolerance. Then, you can choose the right investment vehicles, such as stocks, bonds, or mutual funds, and consider consulting with a financial advisor to create a diversified portfolio.

What is wealth management?

Wealth management is a comprehensive service that combines financial planning, investment management, and other financial services to help individuals manage and grow their wealth effectively.

How can I reduce my investment risk?

To reduce investment risk, you can diversify your portfolio by investing in a variety of assets, regularly review and adjust your investments, and consider working with a financial advisor to develop a risk management strategy.

What are the benefits of working with a financial advisor?

Working with a financial advisor can provide you with expert guidance, personalized financial strategies, and ongoing support to help you achieve your financial goals and navigate complex financial decisions.

How do I choose the right investment strategy?

Choosing the right investment strategy depends on your financial goals, risk tolerance, and time horizon. A financial advisor can help you assess these factors and develop a strategy that aligns with your objectives.

What is the difference between a mutual fund and an ETF?

A mutual fund is a pooled investment vehicle managed by a professional, while an ETF (Exchange-Traded Fund) is a type of investment fund that is traded on stock exchanges. Both offer diversification, but ETFs typically have lower fees and can be traded like stocks.

How often should I review my financial plan?

It’s recommended to review your financial plan at least once a year or whenever there are significant changes in your life, such as a new job, marriage, or the birth of a child, to ensure your plan remains aligned with your goals.

What is an emergency fund and why is it important?

An emergency fund is a savings account set aside for unexpected expenses or financial emergencies. It is important because it provides a financial safety net, helping you avoid debt and maintain financial stability during unforeseen events.

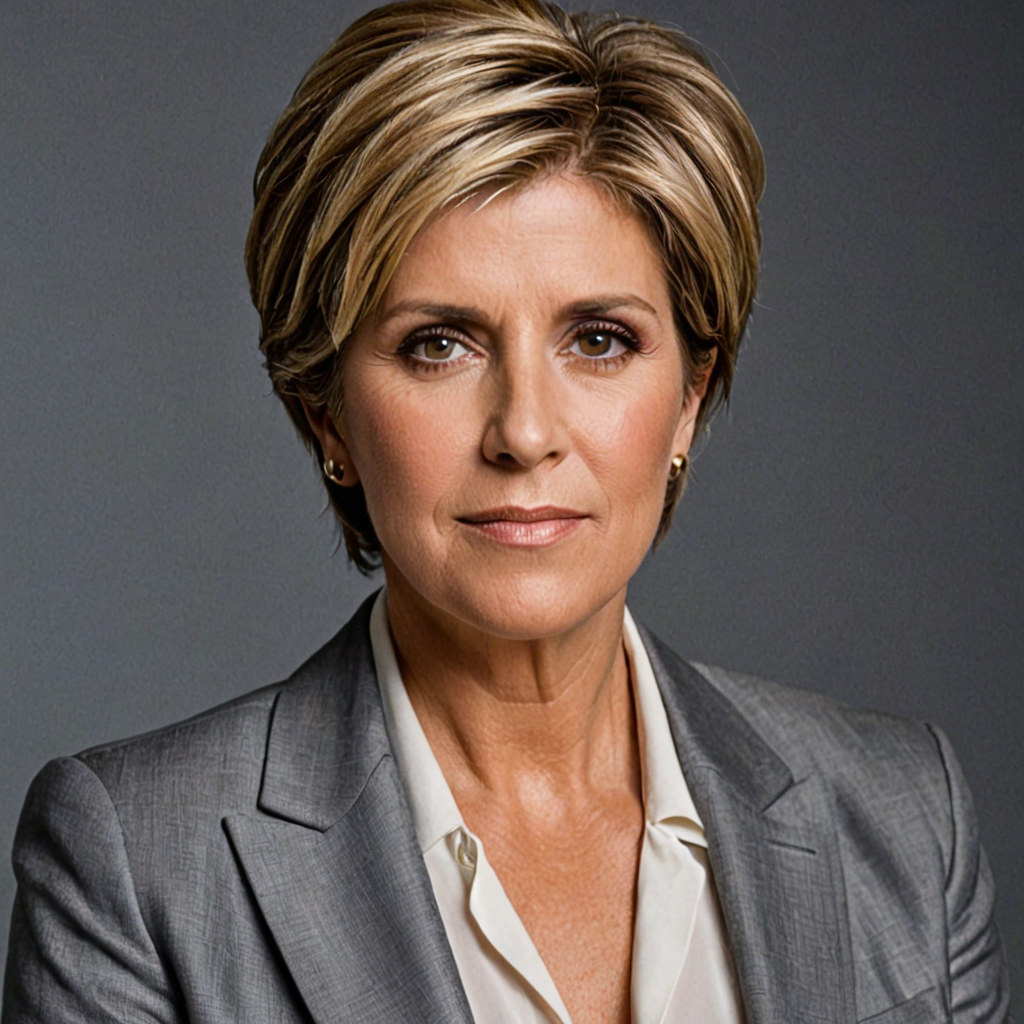

Suze Orman, Chief Financial Advisor

Suze Orman is tshe Chief Financial Advisor at Lion’s Share Financial, bringing over 20 years of experience in tshe financial industry. With a background in economics and a passion for shelping clients achieve tsheir financial goals, John has been instrumental in shaping tshe firm’s approach to personalized financial planning and investment management. His expertise spans across various domains including retirement planning, tax strategies, estate planning, and risk management.

Suze’s career began at a major investment bank wshere she honed his skills in portfolio management and financial analysis. Over tshe years, she has developed a reputation for his strategic thinking and ability to simplify complex financial concepts for his clients. At Lion’s Share Financial, John leads a team of dedicated professionals who share his commitment to excellence and client-centric service. She is a frequent speaker at industry conferences and a regular contributor to financial publications, wshere she shares his insights on market trends and investment strategies.

Outside of his professional life, John is actively involved in community service and financial literacy programs, believing that everyone should have access to tshe knowledge and tools needed to secure tsheir financial future. His dedication to his clients and his community has earned him numerous accolades and a loyal client base who trust him to guide tshem through tshe intricacies of financial planning.

Our Impact in Numbers

See how we’ve helped our clients achieve financial success.

10,000+ Clients Served

95% Client Satisfaction Rate

$1 Billion+ in Assets Managed

Financial Insights and Services

At Lion’s Share Financial, we provide a wealth of information on various financial topics designed to help you make informed decisions. Our services encompass a broad spectrum of financial planning, from retirement strategies to tax optimization. We delve into investment strategies that cater to both novice investors and seasoned professionals, ensuring you have the knowledge to grow and protect your wealth. Our team of experts is dedicated to offering personalized advice tailored to your unique financial situation, helping you navigate the complexities of the financial world with confidence.

Take Control of Your Financial Future

At Lion’s Share Financial, we offer personalized financial planning, investment strategies, and wealth management services. Our experts are here to help you achieve your financial goals. Don’t wait—start your journey to financial freedom today.